agency theory remuneration

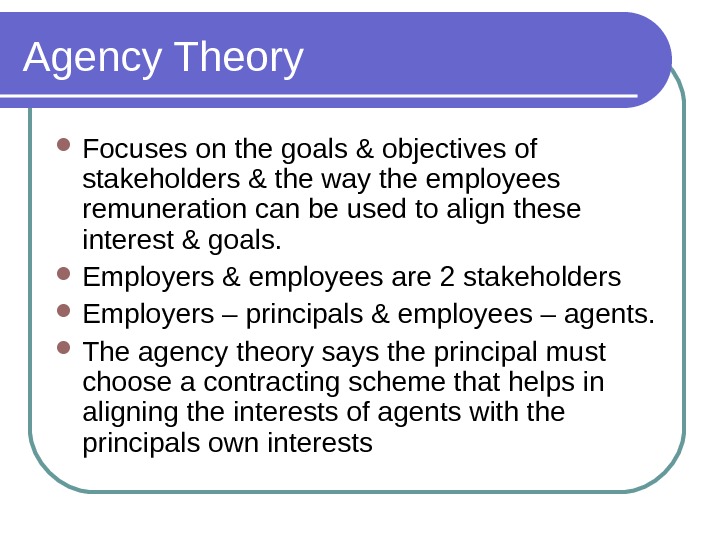

Ineffective remuneration of non-executives are seen as key problems and reasons for the financial crisis. Employers and employees are the two stakeholders of a business unit the former assuming the role of principals and the latter the role of agents.

The agency theory seems to justify high remuneration because of a performance contract where the managerial power theory argues for a dysfunctional system where executives reward themselves more than is necessary.

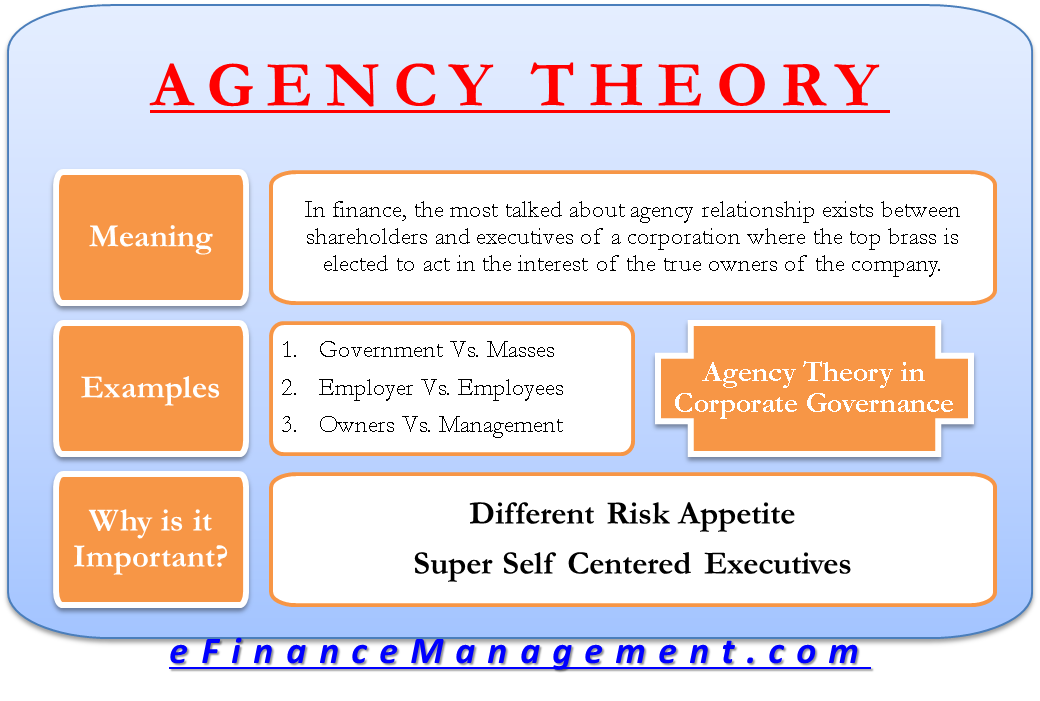

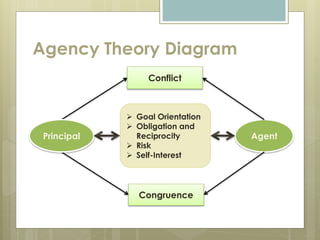

. Agency Theory The agency theory focuses on the divergent interests and goals of the organization s stakeholders and the way that employee remuneration can be used to align these interests and goals. These findings support the agency theory contention as mentioned above that CEO remuneration is a solution to agency costs. In contrast to the standard agency framework which focuses on monitoring costs and incentive alignment behavioral agency theory places agent performance at the.

This new book examines the relationship between agency theory and executive pay. Agency theory speaks to how the employer will remunerate employees to ensure their priorities and goals are aligned with their own. Drawing on ideas from economics psychology sociology and the philosophy of science the author.

Companies that are quoted on a stock market such as the London Stock Exchange are often extremely complex and require a substantial investment in equity to fund them ie. There are various theories in understanding remuneration out of which three different theories will be discussed as follows. In this relationship the principal hires an agent to do the work or to perform a task the principal is unable or unwilling to do.

Usually an individual with more experience gets high remuneration as compared to the fresher irrespective of the nature of a job. This theory states that both the employer and the employee are the stakeholders of the company and the remuneration paid to the employee is the agency cost. Finally using a model-consistent measure of compensation and theory-based estimation we conclude that executive compensation broadly conforms to the principal-agent theory.

This essay shall use the tools of agency theory to analyse remuneration in the financial sector. The main objective of this book is to outline the practical and theoretical issues and discuss and analyze new approaches to direc-tors remuneration due to changes made in corporate governance practices during the post-crisis period. Most commonly that relationship is the one between.

However each situation and the. We illustrate how using theory-based estimation together with a model-motivated measure of total compensation can help overcome these issues. The psychological contract theory.

A problem usually arises when the employees receive fixed pay and know that regardless of performance their remuneration is guaranteed thereby luring the employees to moral hazard. The book examines the relationship between agency theory and executive pay. The employee will try to get an increased agency cost whereas the.

This new book examines the relationship between agency theory and executive pay. Agency theory a mathematised version of Agency Logic Zajac and Westphal 2004 has underpinned most of this research where it has been argued that executive remuneration should be tied to firm performance particularly shareholder returns Dalton Hitt. There has been a plethora of research on executive remuneration Murphy 2013.

The agent represents the principal in a particular business transaction and is expected to represent the best. For the agency theory when information are asymmetric the disciplinary mechanisms of governance have a moderating effect on the remuneration policy and consequently the. They often have large numbers of shareholders.

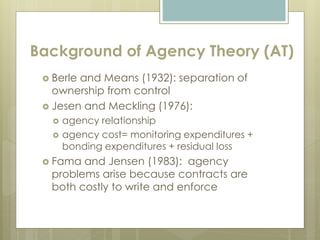

This article studies the links between governance and risk-taking in banks. Agency theory can be applied to the agency relationship deriving from the separation between ownership and control. The theory argues that the value of a firm cannot be maximized if appropriate incentives or adequate monitoring are not effective enough to restrain firm managers from using their own discretion to.

Specifically it will attempt to ascertain whether remuneration policy can lead to excessive risk taking and if this is the case whether it should be controlled by. The agency theory focuses on the divergent interests and goals of the organisations stakeholders and the way that employee remuneration can be used to align these interests and goals. When it comes to executive remuneration and the adoption of these two theories.

Employers and employees are the two stakeholders of a business unit the former assuming the role of principals and the latter the role of. It argues that while Jensen Meckling 1976 were right in their analysis of. Agency Theory Agency Theory explains how to best organize relationships in which one party determines the work while another party does the work.

However the minor economic significance of the cash component of CEO remuneration is consistent with Bebchuk and Frieds 2003 view that CEO remuneration may pose an agency problem. In this theory one party the principal hires another the agent who possesses specialized skills and knowledge. However consistent proof of both theories is still.

THEORY OF REMUNERATION. Agency theory describes managers as agents and shareholders as principals. It argues that while Jensen and Meckling 1976 were right in.

Agency theory is a principle that is used to explain and resolve issues in the relationship between business principals and their agents. It argues that while Jensen and Meckling 1976 were right in their analysis of the agency problem in public corporations they were wrong about the proposed solutions. This theory which explains the relations between owners and managers needs to be revisited in the light of current debates on the performance of companies and the remuneration of their CEOsThis article highlights the developments in agency theory since Adam Smith postulate until today.

Strategy or organizational psychology. For the agency theory when information are asymmetric the disciplinary mechanisms of. Agency theory is used to understand the relationships between agents and principals.

Overview Of Positive Agency Theory Versus Behavioral Agency Theory Download Table

Comparison Between Agency Theory And Institutional Theory Download Table

Agency Theory Strategic Approach And Stewardship Theory Download Table

The Agency Theory With The Assignment Of Work From The Principal To The Download Scientific Diagram

Which Came First Ceo Compensation Or Firm Performance The Causality Dilemma In European Companies Sciencedirect

Performance Magazine An Introduction To Theory In Performance Management Agency Theory And Its Link To Pay For Performance Arrangements Performance Magazine

Relationship Between Agency Theory And The Existing Accountancy Practices Mba Knowledge Base

Compensation Management Session Overview Benefits Of Proper Compensation Consequences Of Inadequate Compensation Concepts Of Wages Components Of Remuneration Ppt Download

Pdf Behavioral Agency Theory New Foundations For Theorizing About Executive Compensation

What Are The Theories Of Compensation Business Jargons

Agency Theory In Corporate Governance Meaning Example Importance

Economic Behavioural Theories Of Wages Nadzirah Zainordin

Agency Theory Strategic Approach And Stewardship Theory Download Table

The Agency Theory With The Assignment Of Work From The Principal To The Download Scientific Diagram

0 Response to "agency theory remuneration"

Post a Comment